Is Singapore’s Property Market Overheated or Just Getting Started?

Home prices keep rising. New launches still pull in eager buyers. Government rules tighten, yet confidence doesn’t shake. Everyone’s asking the same thing: has Singapore’s property market hit its ceiling, or is this just the first chapter of something bigger?

Let’s get honest about where the market stands now and what comes next.

Still Breaking Ground, Not Slowing Down

You might expect fatigue after years of rising prices. That’s not happening.

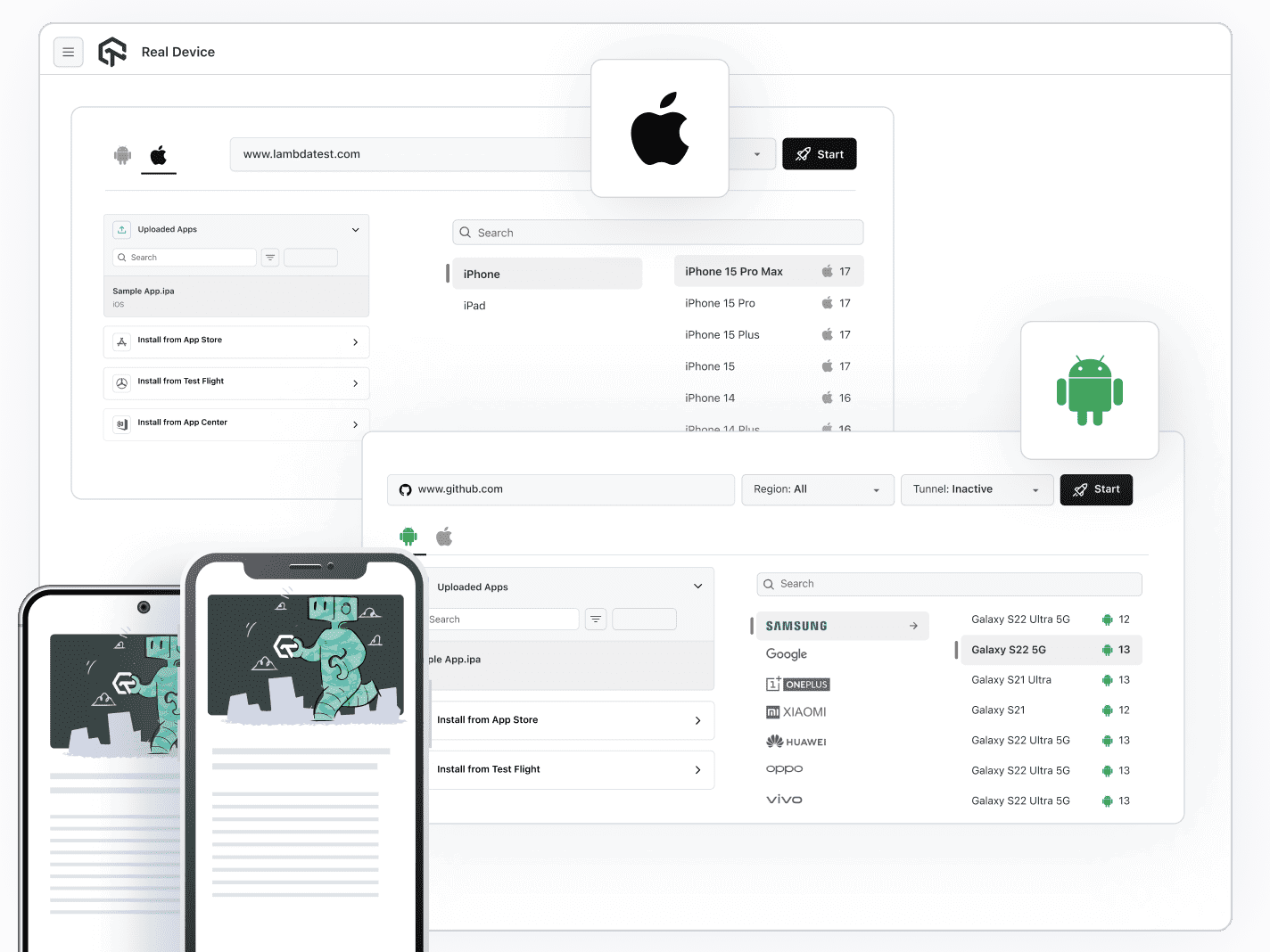

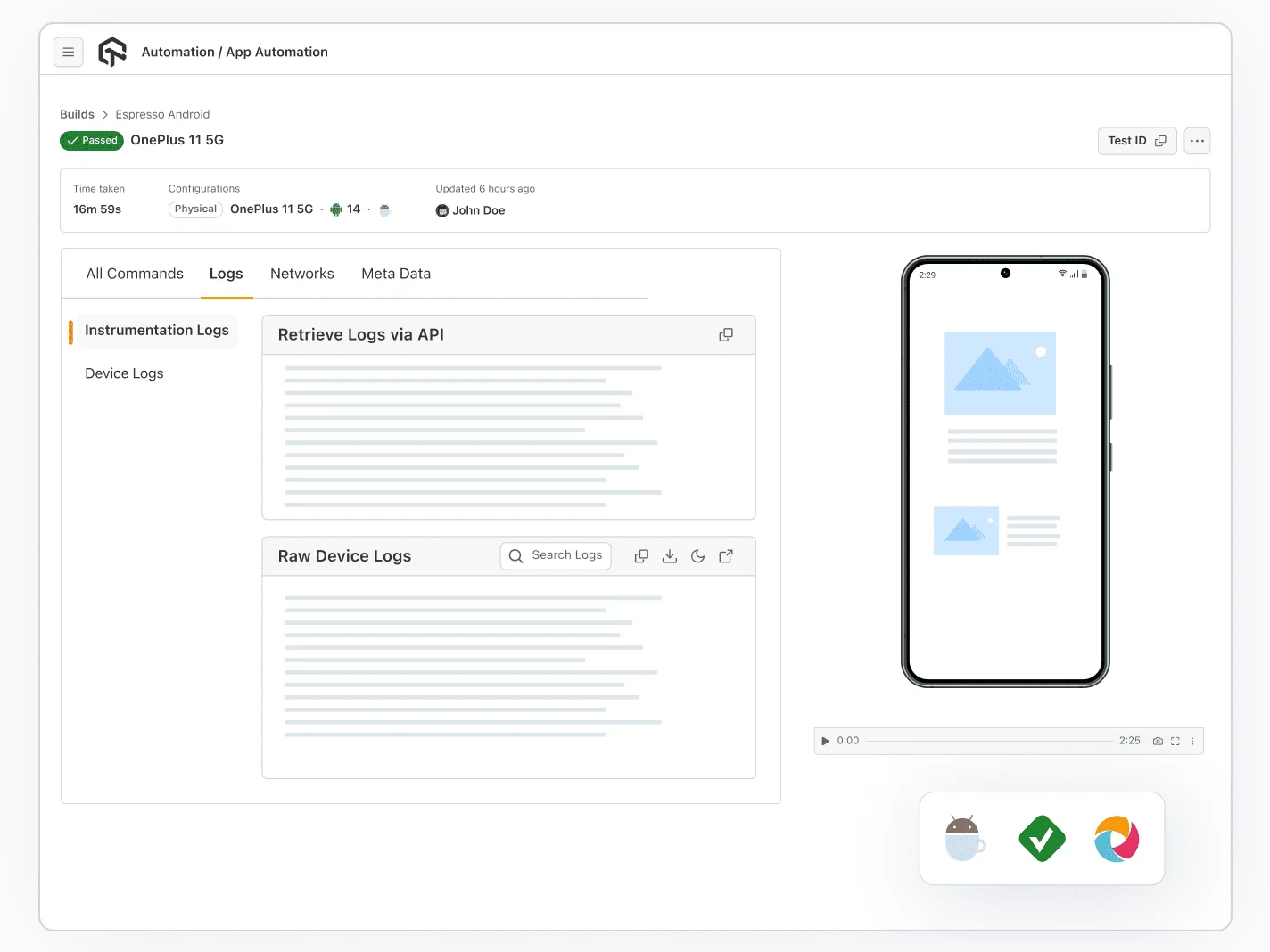

Buyers still queue at launches. Developers continue to acquire land. And major names in real estate are investing more, not less. One such example is Lyndenwoods. It’s backed by CapitaLand, a developer with an unmatched record of building sustainable, tech-forward communities in Singapore.

This is the part you can’t ignore—buyers aren’t just reacting to hype. They’re responding to quality, location, and value that’s built to last.

People are not just purchasing homes. They’re buying into infrastructure, future MRT access, walkable communities, and smarter energy systems. That’s not what happens in a bubble. That’s what happens when a market starts to mature properly.

No Glut, No Crash, Just Careful Planning

You’ve heard it before: “Singapore is running out of land.” That’s not just a cliché—it’s a real limiter. The government tightly controls land sales and project approvals. So, you don’t see massive overbuilding here like in some other countries.

Here’s how it plays out:

- New project releases are staggered.

- Supply remains behind true demand, especially in resale and HDB upgraders’ market.

- Rental stock remains tight, especially in core districts.

When you layer in strict mortgage frameworks, what you get isn’t an overheated mess. You get a market that still has room to grow—slowly and steadily.

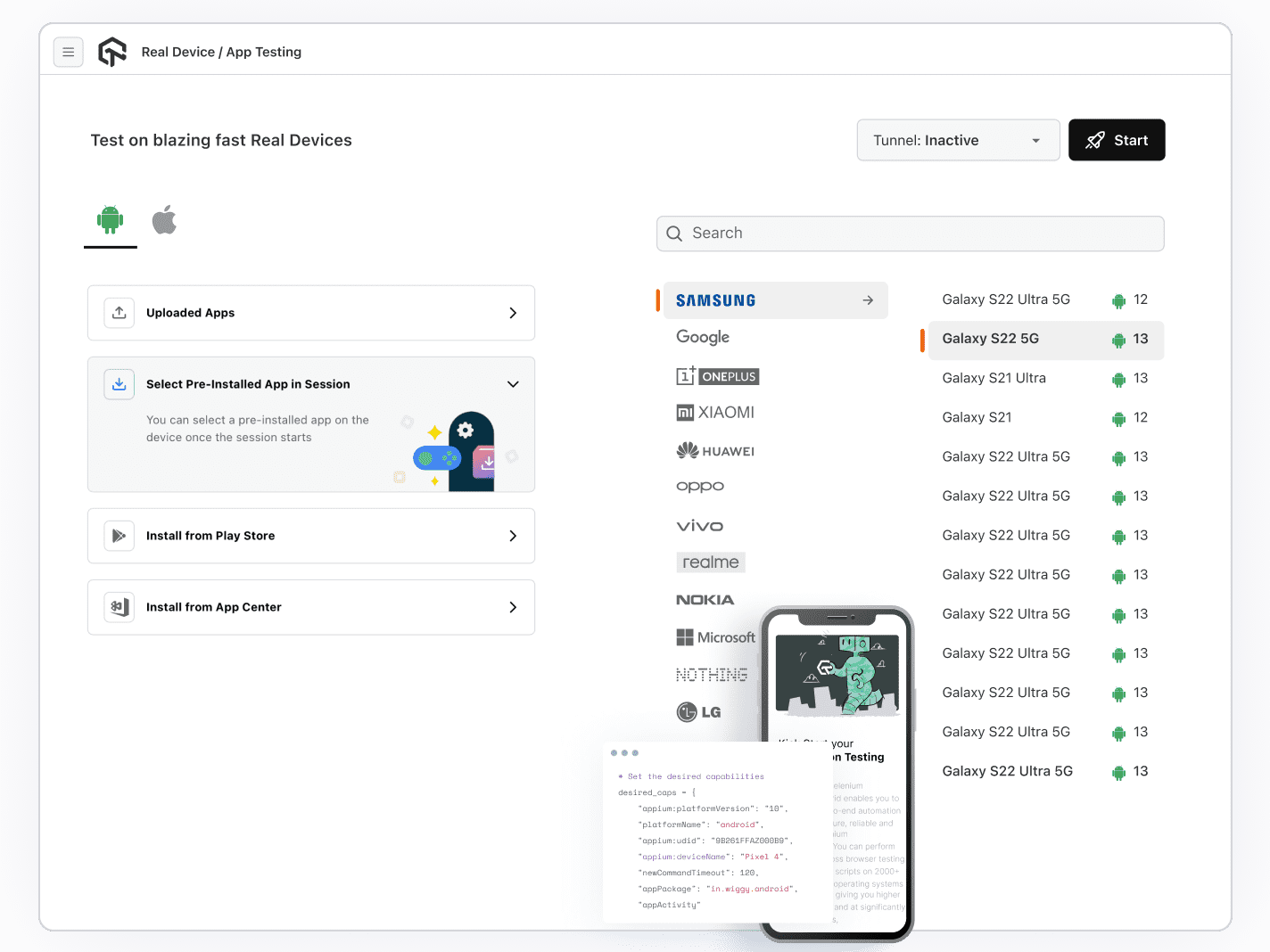

Price Movements Still Show Life

Let’s talk about numbers, because that’s where clarity often hides. Prices rose 8.6% in 2023. First quarter of 2024 showed slower growth, but still positive movement.

- Resale prices in mature HDB towns have touched new records.

- OCR (Outside Central Region) projects are catching up fast.

- Developers are still bidding competitively for GLS (Government Land Sales) plots.

If this was a peak, you’d start seeing soft land interest and long launch absorption. That’s not the case. Instead, the trend looks more like recalibration, not reversal.

Buyers Are Choosing Smarter

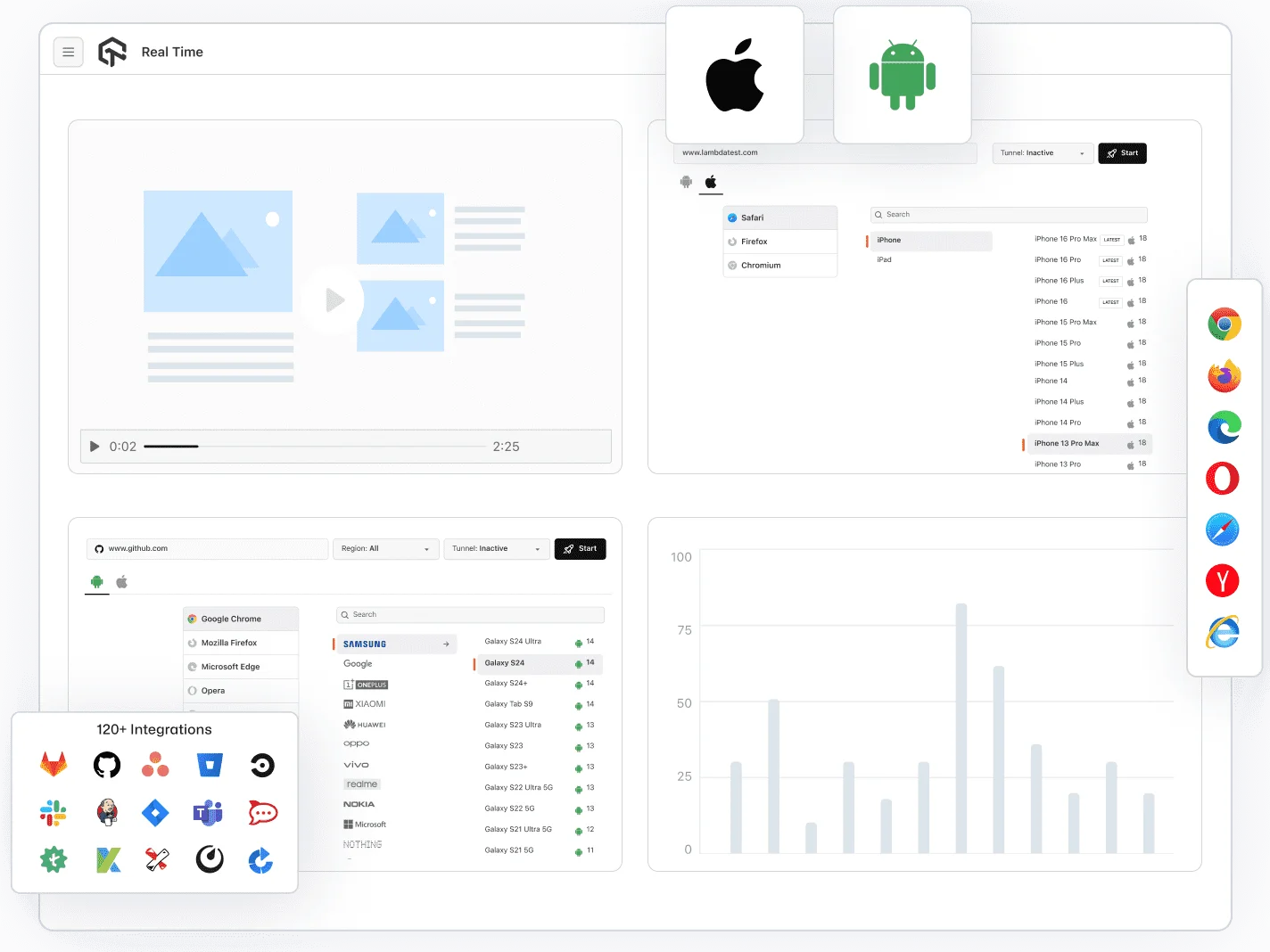

Today’s buyers are sharper. They know what to look for, developer reputation, transit links, efficient layouts, and long-term rental potential. That’s why projects like Grand Zyon continue to gain traction.

The collaboration between CDL and Mitsui Fudosan brings serious credibility. CDL’s reputation for iconic, green-certified buildings aligns with the evolving preferences of new buyers, those who want style, but also sustainability and efficiency. Mitsui Fudosan, meanwhile, adds a refined, user-focused design angle rooted in Japan’s urban planning culture.

It’s not just location anymore. It’s innovation, liveability, and value per square foot. And when you combine those elements, interest stays high, even at premium prices.

Rents Are Climbing, So Are Yields

If you’re on the fence about entering as an investor, look at the rental market.

2024 has seen rents increase, especially for central and city-fringe condos. Tight supply meets strong tenant demand, and that’s a recipe for high yields. In Districts 9, 10, and 11, gross yields have crossed 3.5%, unusual for premium zones.

Rental demand is propped up by:

- Expats returning post-pandemic

- Construction delays in BTO completions

- Families seeking interim homes while upgrading

That’s why many investors hold, even with interest rates rising. The monthly rental returns offer a buffer against loan servicing. As yields improve, the long-term equation starts looking more attractive.

Foreign Interest Isn’t Cooling Off

You’d expect the Additional Buyer’s Stamp Duty (ABSD) hike to drive foreign buyers away. It hasn’t.

Instead, many high-net-worth individuals, especially from China, India, and Indonesia, still choose Singapore as a safe place to park capital.

Here’s why:

- Stable governance

- Transparent legal system

- Strong currency

- Zero capital gains tax

- High liquidity on exit

Foreign buyers don’t buy just for capital appreciation. They look at estate planning, lifestyle relocation, and generational wealth preservation. They’re buying differently, but they’re still buying.

The Urban Landscape Keeps Evolving

No one bets against a city still investing in itself. Singapore’s urban planning pipeline continues to draw long-term investors.

Just look at:

- The Greater Southern Waterfront

- Tengah “Forest Town”

- Paya Lebar Airbase redevelopment

- Cross Island and Jurong Region MRT Lines

All of these reshape value over a 10-year view. Even if today’s prices feel steep, they’re likely to seem reasonable once those areas get transformed.

Long-term players are quietly positioning around MRT growth corridors and future green towns. That’s how wealth is built, in foresight, not panic buying.

Final Thoughts ─ Where Is This All Headed?

Is the market overheated? Not if you look past the surface. Yes, prices are high. But they’re not speculative. They’re supported by structure, policy, and long-term vision.

There’s no fire sale. No mortgage crisis. No developer desperation.

Instead, we’re seeing a more informed market. Buyers are careful. Developers are disciplined. The government is responsive. And the fundamentals still line up.

For those sitting on the sidelines, waiting for a crash, you may be waiting a long time. But for those evaluating with clarity and strategy, the window for sustainable, meaningful growth is still open.