Investing in real estate is a proven strategy for building wealth and diversifying investment portfolios. For individuals interested in the real estate market but seeking a hassle-free approach, Real Estate Investment Trusts (REITs) offer a compelling solution. By providing the opportunity to invest in a diversified portfolio of real estate assets, REITs have gained popularity as a way to access the real estate market without the complexities of direct property ownership. This article explores the concept of REITs, their benefits, and key considerations for those looking to diversify their portfolios. If you’re interested in exploring available properties for rent and sale, listproperties.com, a reputable real estate listing website in the United States, serves as a valuable resource to start your journey.

Understanding REITs

A Real Estate Investment Trust (REIT) is a company that owns, operates, or finances income-generating real estate. By investing in REITs, individuals can become partial owners of a diversified range of property listing website in the United States, including office buildings, shopping centers, apartment for rent complexes, houses for rent, studio for rent, and condos for sale. REITs offer an accessible entry point to the real estate market without requiring investors to directly manage properties.

Diverse Portfolio and Dividend Income

One of the primary benefits of investing in REITs is the opportunity to diversify your investment portfolio while generating dividend income. Here’s how REITs provide these advantages:

- Diversification: REITs typically own and manage a wide variety of properties across different sectors and geographic locations. This diversification helps reduce risk by spreading investments across multiple assets.

- Dividend Income: REITs are required by law to distribute a significant portion of their income to shareholders in the form of dividends. This consistent income stream can be attractive to investors seeking regular cash flow.

Benefits of REITs

Investing in REITs offers several benefits that make them an appealing option for diversification:

- Liquidity: Unlike owning physical properties, REITs can be bought and sold on the stock market, providing investors with greater liquidity and flexibility.

- Professional Management: REITs are managed by experienced professionals who handle property management, maintenance, and tenant relations.

- Accessibility: REITs allow individuals with smaller investment budgets to access the real estate market, which may otherwise require significant capital for direct property listing website in USA ownership.

- Transparency: REITs are subject to regulatory requirements, including financial reporting and disclosures, providing investors with transparency and accountability.

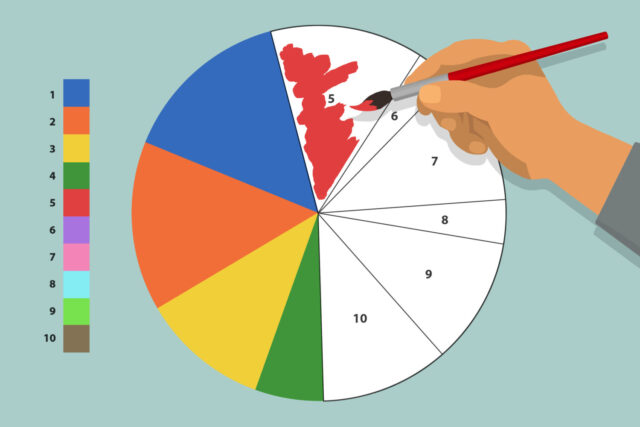

Types of REITs

There are different types of REITs that cater to various sectors of the real estate market:

- Equity REITs: These REITs own and manage income-producing properties. They generate revenue through rental income and capital appreciation.

- Mortgage REITs: Mortgage REITs invest in mortgages and mortgage-backed securities, earning income from interest on the loans they hold.

- Hybrid REITs: These REITs combine elements of both equity and mortgage REITs, often owning properties and providing financing.

Conclusion

Real Estate Investment Trusts provide individuals with an opportunity to diversify their investment portfolios and gain exposure to the real estate market. With their potential for consistent dividend income, liquidity, and professional management, REITs offer a convenient way to access real estate assets without the responsibilities of direct property ownership. If you’re ready to explore the possibilities of diversifying your investment portfolio with real estate listing website in USA that can help you discover available properties. As with any investment decision, conducting thorough research and considering your personal financial goals are essential steps in making informed choices.