In today’s day and age, more and more folks have started to consider investing in precious metals. At first glance, it may seem strange or perplexing – after all, they are just hunks of metal, right? Well, when it comes to gold, silver, platinum, and palladium, there is a little more to the story. Today, that is what we would like to cover.

While it might sound a bit surprising, we have quite a lot to discuss in this realm. You see, while on the surface it is as simple as buying some bullion and stashing it away in your home, there are further intricacies that can make the process somewhat complicated. If you are not necessarily sure how to approach investing in precious metals, then you have come to the right place!

What’s so Special about Precious Metals?

Now, our first order of business is to explain what makes precious metals so valuable in the first place. After all, humans have desired them for thousands of years – essentially, upon their first discovery. Platinum is the one exception to that, but we will explain it further later on.

Each of the metals that we will be discussing here has slightly different chemical and practical qualities that make them appealing. The reasons that people gravitate towards them vary, but at the end of the day, each can be a potential investment. It is up to us to decide which we would prefer.

Silver

First on the docket, we have silver, and it is fairly unassuming compared to some of the other options. With that said, there is a rich history behind our uses for this metal. Largely, though, it has been used in coinage and to make jewelry and other trinkets.

As with the rest of the precious metals, it got an eye-catching sheen. Additionally, it can be used for a lot of practical purposes these days thanks to the way that it is a conductive metal but not a reactive one. This is something that all four that we will be discussing have in common, so it is worth keeping in mind.

There is silver bullion, although it is not as common as gold. It can still be used as a form of investment, though many experts might caution you against it. Do your best to read the literature out there and any reviews that you see from financial experts to see what their conclusions are before you make your decision!

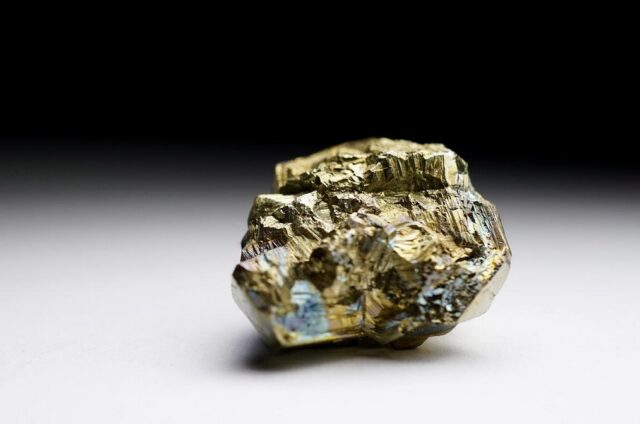

Gold

Now, the start of the show when it comes to precious metals and investing is of course gold. It is what most folks think of when they are asked to consider these types of assets. Whether it is bullion, coins, or something else, chances are that gold will be at the top of the list. Why is that, though?

Well, as you can probably guess, there are a few reasons for it. Namely, though, it is that compared to the other ones that we’ve either discussed so far or will be discussing, gold is relatively unique. Its color alone sets it apart.

Again, it is a type of metal that is quite conductive of electricity, but it is inert. This means that it will not have chemical reactions with other components in a mixture or compound that it comes into contact with. Thus, we have started to utilize it for our electronics, including motherboards for phones and computers!

Resources like this one, https://www.bondsonline.com/patriot-gold-group-review/, can help to explain why it’s so special comparatively. Perhaps most notable is that it has been a symbol of wealth and status for centuries, and potentially even thousands of years. After all, even the Ancient Egyptians and Romans used gold in their jewelry and coinage!

So, this alone sets it apart. However, there is also the fact that in the modern era, many financial experts and experienced investors consider it to be a way to protect ourselves against inflation. This is known as a “hedge” colloquially. Essentially, it is just an asset that will not be impacted by the way that inflation rates change the value of paper currency.

Platinum and Palladium

The final types of precious metals that we would like to discuss in specific today are platinum and palladium. We are lumping them together because they are both in the platinum family and for that reason, they are fairly similar in terms of chemical properties and practical uses.

Jewelry made of either of these metals tends to be quite expensive, especially when compared to silver or gold pieces. The same goes for any that gets smelted into bullion – you would be paying a pretty penny to get some. So, they function a bit differently than the others in the investment sphere.

You can read more about it on this page if you are curious, but we will do our best to explain it as well. Largely, if you are looking to invest in these metals, you will be looking at stocks for companies in the automobile manufacturing industry. That is because they are utilized in this type of manufacturing to help ensure that vehicles reduce fewer greenhouse gas emissions.

How Does Investing Work?

We hinted at this earlier in this article, but it will be unique depending on which of the precious metals you would like to add to your portfolio. Some opt to add a few several types, even, which is not a bad idea. After all, diversifying does not only refer to the types of assets you can add – but also, to keeping your options varied even within a certain asset class.

However, if you can only pick one, most experts would probably recommend gold because of its status as a hedge against inflation. You can buy the bullion directly, invest in a mining company, or even collect coins that have a certain percentage of raw gold within them. These are the sorts of things that you could even deposit into an individual retirement arrangement (IRA) if you were to choose!

At the end of the day, the most important thing to remember is that everyone will have their own unique “journey” of sorts when it comes to investing in precious metals. We have choices throughout the process, whether that is to decide which broker we want to purchase from, the specific type of asset that we want, or even where to store the metals once we have acquired them.

So, do not feel discouraged if you are not sure where to start. Consider working with a consulting company or an advisor if you are really curious about how this all works. That is how a lot of folks get their start, after all.

On one final note, if you are still on the fence whether or not this is worth it, we definitely understand. The thing is that there is a ton of proof out there that demonstrates how it is worth our initial money. The resources we have provided can help you with that, but feel free to do your own research as well!

Considering that gold is a hedge against inflation and that we can get silver relatively cheap, those are where most investors get their beginning with precious metals. You can always dip your metaphorical toes in and decide later on that a specific method is not for you, too – it is not as if liquidating precious metals is a challenging task. So, there’s insignificant risk involved as well.