Small business loans and business credit cards are two of the main options. But how do they differ? What are the main benefits of small business loans and business credit cards?

Does your small business need extra funds for low cash flow, broken equipment, or other urgent situations? Do you need to work with a digital marketing agency such as this site to increase your site’s visibility through search engine optimisation (SEO)?

This article discusses the main differences between small business loans and business credit cards and covers some of their top benefits.

Small Business Loans vs Business Credit Cards: What’s the Difference?

Business credit cards and small business loans may seem the same. While they have some similarities, they’re still different and ideal for various situations.

How are they different? You must repay a small business loan in monthly instalments for a fixed period. Meanwhile, a business card is a “revolving credit line.”

Your business can pay back the loan over whatever period you need. The caveat is you must make minimum payments.

A small business loan is a loan that is typically used by businesses that have an annual income of less than $50,000. A business credit card is a loan that is typically used by businesses that have an annual income of less than $250,000. When deciding which option is best for your business, it is important to consider your specific needs and financial situation.

The main difference between a small business loan and a business credit card is the interest rate. A small business loan has an interest rate of between 6% and 12%, while a business credit card has an interest rate of between 24% and 36%. The other main difference between these options is the terms of the loan. A small loan can be short-term or long-term, while a credit card can only be short-term.

Top Benefits of Small Business Loans

You should consider a small business loan when you need money you can’t pay back quickly. “Quickly” can be within the next few months, for example.

The most important benefits of small business loans to consider include:

Launch or Expand a Business

Whether starting or expanding your business, a small business loan can be wise. Here’s why. The initial costs can be high even for a new small business.

A bank or financial institution may approve a significant amount of money for loans. The amount can be enough to get your company off the ground.

Furthermore, a small loan can help expand your business operations if you already own one. For example, you can use the funds to expand your customer base or geographical reach.

Buy Extra Inventory

Do you have a seasonal business? If so, you may need to boost your inventory during certain times of the year, like winter, summer, or rainy season.

A small business loan can help prepare for the busy months when you generate most of your revenue.

Build Business Credit

Your company can improve its business credit score if a financial institution approves you for a small business loan. Why is this critical? As a startup or new business, improving your credit score can provide various future financial options.

Make sure your business pays its loan payments on time and in full. Taking this essential step can help boost your company’s credit score.

Cover Emergency Expenses

Remember to “expect the unexpected” in life and business.

All companies experience some challenging times. For example, since 2019, many business owners worldwide have needed additional working capital sources during the COVID-19 pandemic.

Your company may experience other emergency situations requiring a small business loan. Suppose your company needs to replace computer or internet equipment. In that case, you can take out a loan to cover the costs.

Top Benefits of Business Credit Cards

Some small business experts recommend that all entrepreneurs have a minimum of one business credit card. One reason is that they’re generally easier to secure than small business loans.

How can you boost the likelihood of your company’s approval for a small business loan? You should have good-to-excellent credit and enough income to prove that you can afford credit card payments.

Small business credit cards can include features like:

- No pre-set limit

- Flexibility on purchases

- Option for minimum payments

- Relatively low-interest rates

Some of the primary advantages of business credit cards include:

Perks and Rewards

Business credit cards include a set of perks that can include:

- Purchase protection

- Extended warranties

- Credits for business expenses

- Deals on travel and car rental

- Insurance products

You can also earn rewards as you make purchases. Such rewards can be cash, points, or miles. These items add value to the credit card. Paying off the balance in full and on time is critical to leverage these rewards.

Another perk that business credit cards can provide is a one-time sign-up bonus. After reaching a minimum spending amount, you can earn a fixed amount of rewards. For example, you may get a $2,000 sign-up bonus within three to six months of opening the account.

A 0% APR

An annual percentage rate (APR) is an annual interest the credit card company charges customers.

Zero-per cent APR is a promotional limited-time feature allowing cardholders to charge and build on balances while not adding interest to the debt for a set period. An example is 18 months.

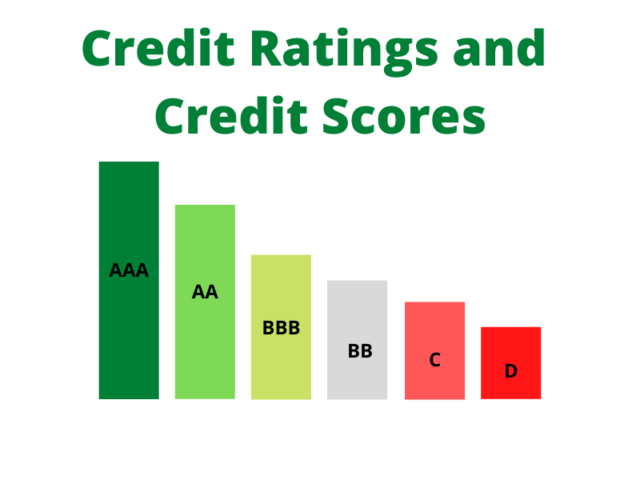

The Effects of Credit Products on Credit Ratings

Remember that all your company’s activities with the business credit card can affect its credit rating. For this reason, you should try to keep the credit card debt significantly below the limit.

Final words

When it comes to financing your small business, there are a number of different options available. Business loan options typically offer lower interest rates and longer terms than credit card options, but they come with stricter requirements. On the other hand, business credit cards can offer more flexible terms but also carry higher interest rates. It’s important to research each option carefully before making a decision, as the right option for you may vary depending on your unique circumstances.