Inflation is in the news, and price increases are being reported daily along with supply chain disruptions. Unfortunately, the car insurance industry is a business also experiencing economic pressure at this time. Car insurance providers are reporting premium increases of 6% to 10%. At the same time, car expenses like gas are also experiencing a cost hike. To understand why this is the case, look at some of the causes and effects of inflation this year in the automobile industry. This post will also talk about some ways to save on your car insurance rates when they are subject to a random increase when it comes time to renew your policy.

Why Car Insurance Rates Are Increasing

For the last two years, the economic damage of the COVID pandemic has caused major commercial disruptions. Supply chain shortages, price inflation, and higher costs reared their ugly heads almost in record amounts. Car insurance rates weren’t increasing because drivers were more reckless or high-risk, but factors beyond their control. While nearly every other business was affected in similar ways, let’s look at the economic effects of COVID and current events on the auto insurance sector.

General Inflation in Car Insurance

Goods and services, in general, are subject to inflation. General costs from manufacturing to sales are increased. This is measured based on percent, wherein the increase was reported to be around 7.5%. In the car world, this would mean that not only are cars more expensive to make, but they can cost more to repair and replace. That is precisely what the job of car insurers is –to cover the costs of repairs and replacements of their policyholder’s vehicle. So now, insurance companies will need to compensate for the higher amount they have to payout with increased rates.

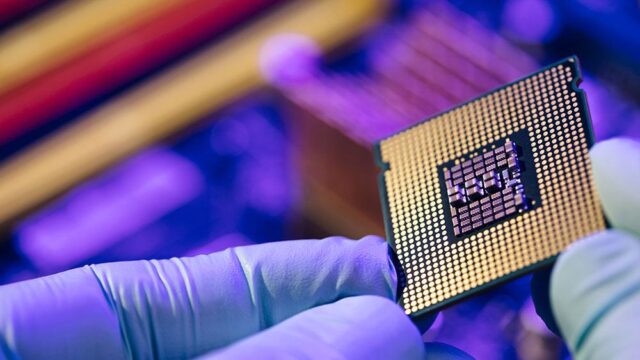

Semiconductor Chip Shortage

Semiconductor chips are small devices that maintain a complete electric circuit. Nearly every electronic device on the planet requires one to function –your phone, computer, televisions, entire hospitals, and whatever else needs to power up. Cars and airplanes also require them due to their electronic parts and capabilities. Last year, a chip shortage on the manufacturers’ part shut down several car production facilities for a period of time. Manufacturers were able to produce more, but the shortage took time to recover from. This was also a serious issue for the auto insurers because if one of their policyholders’ cars were to suffer an electrical malfunction and need a new chip, it wouldn’t be easy to replace. This would also make newer cars intended to serve as replacements more expensive. The good news is that chips don’t cost more to make; the makers just had to catch the supply up with the demand. Still, it was a reason for increased auto premiums.

Car Inventory Shortage

Semiconductor chips weren’t the only products that were short. Because several automakers shut down their production lines, cars were in short supply as well. New cars weren’t getting made without the crucial part. Because of this, new cars on the market have their asking prices inflated. This is not the best thing for new car owners or those looking to get car insurance. A factor that determines how much car insurance costs is the car’s value. Unfortunately, inflated values count as well. This isn’t just the case for those that own their cars. Rental car prices are subject to increase as well. Of course, drivers of rental cars also have to get car insurance of their own which is also inflated. If you would like to learn more about cheap car insurance rates, click here.

Totaled Car Replacement

When a policyholder’s car is totaled in an accident, insurance providers have to provide a significant payout to help replace it. For the reasons just covered, cars cost more to replace when there’s a shortage and inflation. So insurance companies have to pay more in the event of such an accident. When a car is totaled, that means that the cost to repair it costs more than the value of the car. As previously mentioned, the value is increased, and so are the repairs.

Auto Worker Shortages And Repair Costs Increases

The car industry also experienced a shortage of personnel, particularly technicians and mechanics. While the cost of services has been increasing, the same can’t be said for the amount the technicians are getting paid. This can not only result in repairs being more costly but more lengthy.

COVID Sanitation Process And Cost

Since COVID became a pandemic, auto shops and other businesses have been required to have their facilities cleaned in a specialized process designed to purge COVID bacteria and germs. Auto shops often included this service to repair jobs. Of course, this adds a fee to the total repair bill. As this post has stressed, higher car repair costs are a reason for increased insurance rates.

To decrease car insurance in Ontario, consider raising your deductible, maintaining a good driving record, and bundling your car insurance with other policies such as home insurance. Additionally, exploring available discounts and shopping around for competitive quotes from various car insurance providers in Ontario can also help you find the most affordable coverage.

Ways to Decrease Car Insurance Rates

In the face of all these increased car expenses and insurance rates, the average reader is naturally wondering ways they can save. The good news is that all the traditional ways to save on auto insurance are still viable options:

- Increase deductible – A car insurance deductible is directly inverse to the premiums. The deductible is the amount the policyholder pays when they file a claim and before their provider covers the damage. The higher the deductible, then the lower the premiums are.

- Always explore discounts – Good driving, student, bundled insurance, and several more discounts are readily available from insurance companies. It always helps to inquire about any discounts when looking at new car insurance.

- Improve credit score – Several insurance companies look at potential customers’ credit scores to gauge their financial responsibility since that is what insurance is all about. The riskier they find someone to be, then the higher their insurance rates will be. So, it really helps to pay bills on time.

- Driver tracking discount – Apps and software can be used to track a potential policyholder’s driving habits, thus providing a track record for the insurance company. If it is a satisfying driving history, a discount may be in order.