The Singapore property market in 2025 is defined by cautious optimism. Prices continue to rise moderately after a brief correction in 2024, while developers focus on sustainable design, integrated communities, and smart-living features.

Despite global uncertainty, demand in the city-state remains resilient, driven by limited land supply, a stable economy, and consistent foreign investor interest. The next two years will see a surge of new projects that reflect changing buyer priorities, compact luxury, proximity to transport, and energy efficiency now matter more than ever.

A Market Shaped by Policy and Precision

The Urban Redevelopment Authority (URA) has maintained steady control over the private housing pipeline. Cooling measures introduced in 2023 continue to moderate speculative buying, but they have not dampened genuine owner-occupier demand. The Additional Buyer’s Stamp Duty (ABSD) has particularly reshaped foreign participation, with many investors turning their attention toward long-term rental yield rather than short-term flipping.

Local buyers, especially younger families and dual-income professionals, remain the strongest market force. They are drawn to upcoming developments that combine accessibility, compact layouts, and comprehensive amenities. These factors contribute to a steady absorption rate in the primary market, even when global interest rates fluctuate.

Demand Concentrating in Transit-Oriented Districts

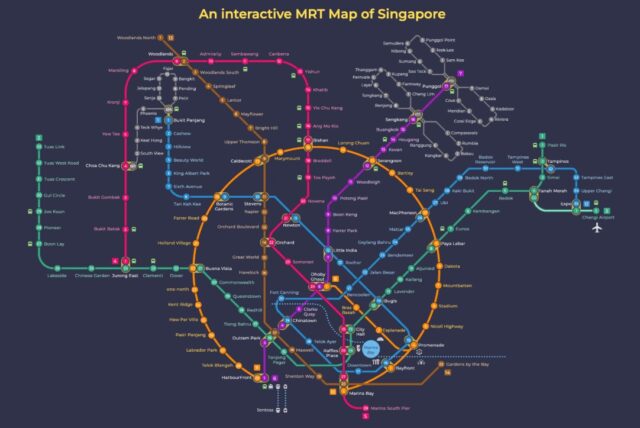

MRT connectivity remains the single most influential factor for new property demand. Areas within a 10-minute walk of a station, particularly those linked to new lines like the Cross Island Line (CRL) and Jurong Region Line (JRL), are witnessing strong developer interest and record land bids. Buyers prioritize convenience over size, leading to a market shift toward efficient unit layouts with flexible interior design.

Districts such as Tampines North, Lentor, and Pasir Ris are prime examples. These neighborhoods combine mature infrastructure with new mixed-use developments. Retail, schools, and public transport all converge to create self-contained communities, aa that continues to shape Singapore’s urban planning philosophy.

Rising Emphasis on Sustainable and Smart Design

Environmental sustainability is now a decisive factor in both planning approvals and consumer preference. Developers are adopting green certifications, integrating solar panels, rainwater harvesting, and passive ventilation systems into their designs. Buyers increasingly expect energy-efficient appliances and low-carbon building materials as standard, not luxury extras.

This sustainability push is complemented by digitalization. Smart home systems, from app-controlled lighting to automated climate control, are becoming essential selling points. These innovations enhance comfort and reduce utility costs, aligning with Singapore’s Green Plan 2030 and the city’s broader target of achieving net-zero emissions by mid-century.

Prime Developments Reflecting Modern Living

Upcoming residential launches continue to demonstrate how the market adapts to evolving buyer behavior. For example, Pinery Residences represents the new generation of integrated-lifestyle developments. Located in a growth corridor with direct access to transport and retail clusters, it offers compact but functional layouts ideal for professionals and small families. The project aligns with the trend toward community-driven living, emphasizing shared green spaces, fitness areas, and multipurpose rooms over large private balconies.

Projects like this illustrate how Singapore’s property developers are repositioning their value proposition: space is now measured by quality and flexibility, not sheer size. This approach appeals to both local and expatriate tenants who prioritize convenience and design efficiency.

Limited Land Supply and Government Planning

Singapore’s land scarcity continues to underpin its long-term property value. Each Government Land Sale (GLS) exercise attracts strong competition, with per-square-foot prices maintaining stability despite global inflationary pressures. Developers are expected to remain selective, focusing on mid-sized plots in established residential zones rather than speculative high-density builds.

The government’s long-term planning in areas such as Tengah, Jurong Lake District, and the Greater Southern Waterfront will define the next decade of residential growth. Tengah, for instance, will serve as Singapore’s first “smart forest town,” integrating sustainability, walkability, and digital infrastructure, all concepts that resonate deeply with younger buyers and forward-looking investors.

Rental Market Stability and Yield Potential

After two years of high volatility, the rental market is stabilizing. Median rents for condominiums have plateaued since Q2 2025, with stronger resilience in city-fringe and suburban zones than in the Core Central Region (CCR). Expats returning post-pandemic are choosing more cost-efficient housing options near business hubs like Paya Lebar and One-North rather than central areas.

Rental yields currently average between 3.5% and 4.2% for well-located suburban units. This stability ensures continued interest from long-term investors, especially those seeking to offset rising financing costs with consistent returns. However, the government remains vigilant about maintaining housing affordability for locals, meaning further tightening measures are unlikely unless speculative activity resurges.

A Second Wave of Urban Transformation

Singapore’s property landscape is entering what planners describe as a “second wave” of urban transformation. The first wave (2010–2020) focused on redeveloping older housing estates and expanding MRT coverage. The current phase focuses on decentralization, bringing work, leisure, and housing closer together outside the downtown core.

This is visible in hubs like Punggol Digital District and Woodlands Regional Centre, both designed to support job creation and local amenities simultaneously. Such decentralization reduces commuting times, strengthens community networks, and keeps housing demand diversified across the island rather than concentrated in a few high-priced enclaves.

The Role of Luxury and Boutique Projects

While mass-market condominiums continue to dominate sales volume, boutique developments are quietly shaping the high-end segment. One of the notable trends is the rise of smaller, design-focused luxury residences that target discerning local and foreign buyers seeking exclusivity and architectural distinction rather than size.

An example is Narra Residence, a boutique development that reflects the growing preference for privacy and craftsmanship in the luxury market. Its design approach underscores how top-tier buyers now prioritize location authenticity, aesthetic value, and long-term liveability instead of speculative resale potential. Boutique properties like this help diversify Singapore’s residential landscape, ensuring a more balanced spectrum of choices.

Outlook ─ Controlled Growth, Sustained Confidence

Looking ahead, analysts expect private home prices in Singapore to grow by 3–5% annually through 2026. This is a realistic pace that reflects the balance between rising construction costs and moderated demand under regulatory oversight. The government’s emphasis on housing affordability and infrastructure expansion will continue to support overall market stability.

Demand for suburban and fringe areas is expected to remain healthy, driven by upgraders from HDB flats and new family formations. Meanwhile, the luxury and core-central segment will benefit from the gradual return of foreign professionals and high-net-worth individuals seeking stable, long-term investments in a politically and economically secure city.

Final Assessment

The Singapore property market remains among the most disciplined and resilient globally. Every trend, from transit-oriented development to sustainability mandates, reflects deliberate planning rather than speculation. The market’s strength lies not in unrestrained growth but in balance, supported by consistent demand, transparent regulation, and long-term investor trust.

For 2025 and beyond, success in property investment will depend on recognizing where urban renewal and lifestyle evolution intersect. Projects that integrate connectivity, green infrastructure, and smart design, like the examples mentioned, represent the true direction of Singapore’s housing future.